The Top Features to Try To Find in a Home Loan Calculator for Better Choice Making

The Top Features to Try To Find in a Home Loan Calculator for Better Choice Making

Blog Article

Smart Finance Calculator Service: Improving Your Economic Estimations

In the world of economic management, efficiency and precision are paramount. Envision a device that not just simplifies intricate loan calculations but additionally offers real-time insights into your financial dedications. The clever loan calculator service is designed to streamline your monetary computations, using a seamless way to evaluate and prepare your fundings. By harnessing the power of automation and advanced formulas, this tool exceeds simple number crunching, transforming the method you approach financial preparation. Whether you are an experienced investor or a newbie customer, this ingenious remedy guarantees to redefine your monetary decision-making procedure.

Advantages of Smart Financing Calculator

When evaluating economic alternatives, the advantages of making use of a smart lending calculator come to be evident in facilitating notified decision-making. These calculators supply users with a device to accurately determine funding repayment quantities, rate of interest, and settlement schedules. Among the key benefits of using a wise car loan calculator is the capability to contrast various lending options promptly and successfully. By inputting variables such as car loan amount, passion rate, and term size, people can assess various situations to choose one of the most cost-efficient choice customized to their economic situation.

Moreover, wise car loan calculators use openness by damaging down the total cost of borrowing, including passion settlements and any kind of additional fees. This transparency encourages individuals to comprehend the financial implications of obtaining a funding, allowing them to make audio financial choices. Additionally, these devices can save time by giving instant calculations, getting rid of the demand for complex spread sheets or hand-operated calculations.

Functions of the Tool

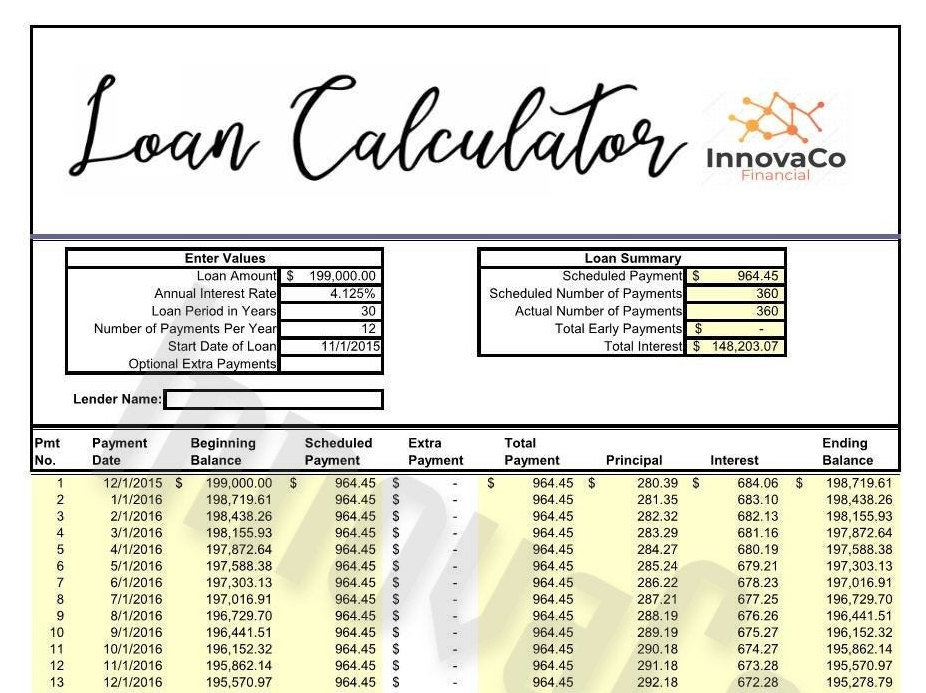

The tool incorporates a straightforward user interface created to improve the procedure of inputting and analyzing financing data successfully. Customers can quickly input variables such as car loan amount, rates of interest, and finance term, enabling fast calculations of month-to-month settlements and complete passion over the lending term. The device likewise offers the adaptability to change these variables to see exactly how changes influence the general car loan terms, equipping individuals to make enlightened monetary choices.

Furthermore, the clever loan calculator gives a breakdown of each month-to-month payment, showing the part that goes in the direction of the major amount and the passion. This function aids individuals imagine exactly how their payments contribute to repaying the finance gradually. Furthermore, users can create detailed amortization timetables, which outline the payment routine and interest paid each month, aiding in lasting economic planning.

How to Utilize the Calculator

In navigating the funding calculator effectively, customers can easily take advantage of the straightforward interface to input vital variables and produce valuable economic understandings. To start making use of the calculator, customers ought to initially input the loan amount they are thinking about. This is typically the total amount of money obtained from a loan provider. Next, individuals require to go into the funding term, which describes the duration over which the finance will be settled. Following this, the passion rate should be inputted, as this considerably influences the see post total cost of the car loan. Customers can additionally define the repayment frequency, whether it's monthly, quarterly, or yearly, to straighten with their economic planning. When all required fields are completed, pressing the 'Calculate' button will quickly process the details and give important information such as the monthly repayment quantity, complete interest payable, and general financing price. By adhering to these straightforward steps, individuals can effectively make use of the funding calculator to make educated economic choices.

Advantages of Automated Computations

Automated calculations improve monetary processes by swiftly and precisely calculating intricate numbers. Among the key advantages of automated computations is the decrease of human error. Manual estimations are susceptible to blunders, which can have substantial implications for economic choices. By utilizing automatic devices, the danger of mistakes is decreased, guaranteeing greater accuracy in the outcomes.

In addition, automated computations conserve time and increase effectiveness. Complex financial estimations that would normally take a considerable amount of time to complete manually can be performed in a portion of the moment with automated tools. This allows monetary professionals to concentrate on evaluating the outcomes and making informed decisions look these up instead than spending hours on computation.

This uniformity is essential for contrasting various financial situations and making sound monetary selections based on exact data. home loan calculator. Generally, the benefits of automated calculations in streamlining financial procedures are obvious, offering raised accuracy, performance, and uniformity in complex economic calculations.

Enhancing Financial Preparation

Enhancing economic planning involves leveraging advanced tools and techniques to maximize financial decision-making processes. By making use of sophisticated economic preparation software and individuals, calculators and companies can gain much deeper understandings into their financial health, established realistic goals, and establish actionable strategies to achieve them. These devices can evaluate different financial circumstances, job future results, and offer suggestions for efficient riches administration and risk mitigation.

Moreover, improving monetary planning incorporates incorporating automation and artificial intelligence into the procedure. Automation can simplify routine monetary jobs, such as budgeting, cost monitoring, and investment monitoring, liberating time for calculated decision-making and analysis. AI-powered tools can use tailored monetary guidance, recognize patterns, and suggest optimum investment chances based upon private danger profiles and monetary purposes.

Furthermore, cooperation with financial experts and specialists can improve financial planning by using valuable understandings, market knowledge, and personalized approaches customized to specific economic goals and situations. By incorporating sophisticated devices, automation, AI, and specialist recommendations, organizations and individuals can raise their economic planning abilities and make notified choices to safeguard their economic future.

Final Thought

To conclude, the clever loan calculator remedy offers various advantages and attributes for improving financial calculations - home loan calculator. By utilizing this tool, individuals can conveniently compute funding payments, rates of interest, and like it settlement timetables with precision and performance. The automated estimations offered by the calculator improve financial preparation and decision-making procedures, ultimately causing much better monetary administration and notified choices

The clever car loan calculator remedy is made to simplify your monetary computations, supplying a smooth method to assess and prepare your finances. On the whole, the benefits of automated computations in improving economic procedures are undeniable, supplying increased precision, effectiveness, and uniformity in complex monetary computations.

By using sophisticated monetary planning software program and calculators, individuals and companies can get deeper understandings into their monetary health, set realistic goals, and develop actionable strategies to accomplish them. AI-powered devices can supply customized monetary recommendations, recognize trends, and recommend optimal financial investment chances based on private risk profiles and financial goals.

Report this page